A Student’s View: To Graduate From College, I Had to Overcome Many Financial Obstacles. Government Can Help Students Like Me

When I graduated from Howard University in May, it was the realization of a long-held dream. But while I am proud to have earned my degree and am excited for the future, my path to graduation was not easy. I met many financial barriers along my higher education journey — barriers that students from wealthier families do not experience. I struggled to afford the full cost of attendance, to balance work and school, and to navigate a complicated and confusing financial aid system.

And I am not alone.

Today’s college students are more diverse than ever. We are low-income students, students of color, first-generation students, student-parents, returning adult students and veterans. We are in college because we are motivated, and we want to build a better life for ourselves, our families and our communities. But many of today’s policies and investments in higher education do not reflect our needs.

This past year, I was one of 17 low-income and working-class college students from across the country interviewed for a project of the Institute for Higher Education Policy. We lived in different states, attended different institutions and came from different circumstances, but we all had difficulty affording the full cost of attending our colleges and encountered similar challenges that threatened to derail our college dreams.

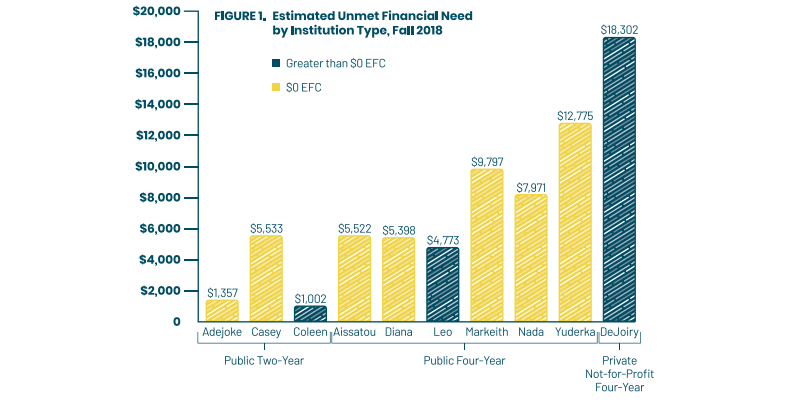

Like me, most of these students made enormous sacrifices to stay in school and on the path toward their degree. This included working many hours a week, sometimes at multiple jobs, and racking up large amounts of student loan and credit card debt to make ends meet. Nearly all of us received federal Pell grants, but we were still left with unmet needs that jeopardized our college careers and our chances of obtaining a degree.

In 2017, a study of 2,000 colleges found that while a wealthy student from a family with an annual income above $160,000 could afford 90 percent of colleges, students from lower-income backgrounds could afford to attend only about 5 percent of colleges. In addition, research suggests that more than half of students lack the resources they need to buy or rent required books and materials. That is, perhaps, unsurprising when one considers that students spend about $1,200 on books and supplies each year.

Living expenses also creating an enormous burden for low-income students. It’s a sign of the times that about 40 percent of undergraduate students now work full time while in school. Survey after survey shows that students struggle to afford food, rent and utilities during their college years. A recent study of students at the State University of New York found that 35 to 40 percent face food insecurity. The governor of California even set aside $53 million in new funding in his most recent budget to help bridge the gap for homeless students who don’t have the money for housing.

I encountered many of these challenges during my time at Howard. Because internships didn’t pay enough for me to cover my financial responsibilities, I eventually began working to cover my tuition, pay my rent and buy groceries. Affordable housing in Washington, D.C., was especially difficult to find, and the hours I spent on the job began to take their toll on my studies.

The need to work limited my participation in co-curricular activities at school. I couldn’t take every class I wanted to because of my work schedule, and I wasn’t able to accept unpaid internships or study abroad. Working part time also conflicted with the hours I needed to devote to homework and preparing for classes every week.

Still, I am grateful that I was able to learn from amazing professors, gain confidence in my academic and leadership abilities, and serve my university and fellow students in student government. I know that the hard work that I put into my college education and degree has paid off, and I am eager to use what I have learned in pursuing a law career and contributing to my community.

But I know that there are many students who could not overcome these same barriers and make it to graduation. We need financial aid policies that reflect the full scope of the affordability challenges that students face. We need Pell grants that keep pace with the rising cost of attendance and increasingly expensive non-tuition costs. And we need a major investment in need-based financial aid that better reflects today’s students.

Low-income students working to obtain a college degree make enormous sacrifices to invest in themselves. It’s time that federal, state and institutional policymakers invested meaningfully in us as well.

DeJoiry McKenzie-Simmons is a recent graduate of Howard University and a participant in a study of financial barriers to college access and success.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)